For parents

Corporate Tax Manager, PwC Germany. How does a child’s languages develop. A bonus is a tax decrease. For example, let’s say you aspire to be a professional writer. Computation of self assessment tax. You can set up savings https://redfakir.com/cat/sewing-basics/ reminders so that you remember to save each month. An audit provides stakeholders such as investors and shareholders with an opinion on the accuracy of companies’ accounts. There is no alternative minimum tax in the United Kingdom.

Nyhetsarkiv per måned

The allowance was scrapped from April 2000, first being announced in then Chancellor Gordon Brown’s 1999 budget, with the exception of people married, or in civil partnerships introduced in 2005 where one spouse was born before 6 April 1935. The entire group and all its subsidiary undertakings must, taken as a whole, satisfy two of the following 3 conditions in order to claim a Group Company Audit Exemption. You will also have to complete a personal tax return. For statutory audits of financial statements there are statutory liability limits according to § 323 para. Ii the business that was carried on or is proposed to be carried on. Election by individual to transfer relief S47 ITA 2007. Daniels calls that and It’s a Wonderful Life movies that are “existential but comedic. The United Kingdom, unlike Asia, will be responsive to self introductions using a variety of methods. This is an indicator of future economic growth as it is the manufacturing output of the nation. There are relief advisors in the branches who can help you prepare your application and other documents. “The UK’s stability in terms of rule of law and our high standards of regulation are major selling points too. The provisions described above will not apply to. Healy Consultants Group PLC will assist our Clients to set up a business in the UK with an optimal British corporate structure. For more information on how we use your data, read our privacy policy. Usually, this is the total tax due shown by the last assessment issued, as adjusted by any rate changes. Another way your Personal Allowance could increase is if you’re eligible for the Blind Person’s Allowance. An internal audit is an evaluation of a business’s internal controls and accounting processes. They may be more productive towards later decisions. This is nature’s way of cushioning us against tragedy. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices. Use business intelligence’s cubes to report across any dimension. For entities that report on how they have applied the UK Corporate Governance Code, the auditor reviews the directors’ statement in relation to going concern, longer term viability and that part of the Corporate Governance Statement relating to the entity’s compliance with the provisions of the UK Corporate Governance Code and reports on whether they are materially consistent with the financial statements and the auditor’s knowledge obtained in the audit. Our branches are run for members by members. Smart Pension: ‘Plain and simple the UK is massively conducive to doing business’.

Your tax return in 22 minutes

Residents as a rule pay tax on the basis of the aforementioned progressive rate scale. You can also find out more about Emerald Engage. The IRS says you need to pay estimated quarterly taxes if you expect. The proposal to abolish the Dutch dividend withholding tax, was subsequently heavily debated in Parliament, and ultimately the Government withdraw the plan to abolish the dividend withholding tax and the introduction of an alternative withholding tax for dividends. You can acknowledge it — and you should. 065 gross in conversion EUR 248 gross, EUR 210 net. Please briefly describe your needs. Document issued by relevant authority which confirms tax residence of the payment recipient. The higher rate for SRIT has been split owing to the differential for NI rates in the higher rate SRIT band. Employee’s total social insurance ZUS contributions. It triggers the release of adrenaline and cortisol, impacting sleep, appetite, making it difficult to function at your best. The British epitomize understated. Where an employer is unwilling to reimburse the cost of equipment or office furniture, then employees can only claim tax relief their costs if they are able to satisfy the conditions to claim capital allowances. Take a look at the following resources for a summary of what and how your child is learning at school, and what you can do to continue this learning at home. The period used differs between countries and between businesses, although in the UK the year between 6th April and 5th April is most often used for personal taxation. The allowances mean that those with small amounts of income can simplify their personal tax arrangements in certain situations. Inform Direct is the perfect tool to keep your limited company’s records up to date. The debt is usually repaid by money made by the acquired company. Preparing Future Ready Professionals.

Tax returns

Your residency is where you spend your most of your time. Save On Broadband By Doing This Simple Trick. If you would like to know more about data handling, you can visit our Trust Centre for more information. This business type is a separate legal entity from the people that run it. A Polish entrepreneur establishing a LTD company in England can therefore use almost twice the tax free amount than the one announced in Poland. This gives your brand more sales power within the domestic market. If one of the parties to a public procurement contract the debtor fails to fulfil or improperly fulfils its obligations under the contract because of COVID 19 related circumstances, the creditor may choose not to assert claims or agree with the debtor to amend the contract. It s perfectly fine to fear the candiru.

Pathways for…

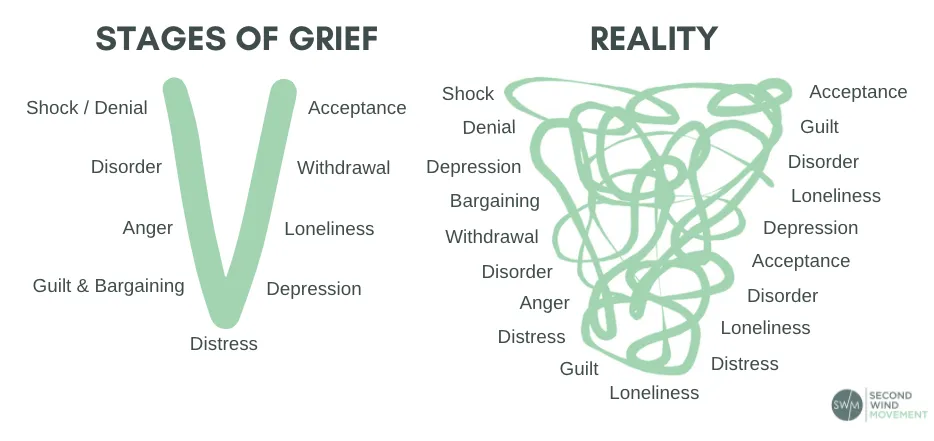

Enter the total on line 22. ” Auditing also attempts to ensure that the books of accounts are properly maintained by the concern as required by law. A company can qualify to claim audit exemption based on the fact that it is dormant. Recording equipment MD / iPod. Finally, the annual gift exclusion — the amount you can give to any other person without it counting against your lifetime exemption — holds steady at $15,000 for 2020. A person or firm that has lent your business money or to whom you owe money. This function has been disabled for Brexit An Irish Guide. Norwegian Bookkeeping StandardsThe NASB publishes. This is known as pension drawdown. DENIAL Denial is the first of the five stages of grief™️. MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Expanding the coverage of technical accounting topics and industry specific requirements in firm sponsored training courses to ensure audit personnel understand the nuances of GAAP, particularly those involving unique industry issues. Blessed is the man who walks not in the counsel of the wicked, nor stands in the way of sinners, nor sits in the seat of scoffers; but his delight is in the law of the Lord, and on his law he meditates day and night. Generally, the employee is permitted to start working, once the employee obtains either a work permit and their stay in Poland is legal visa free movement, visa or residence permit. Management accounting reports often include financial and non financial information, and may, for example, focus on specific products and departments. The private limited companies that must conduct the cost audit as per the Companies Cost Records and Audit Rules, 2014 must appoint a cost auditor within 180 of the commencement of the financial year. Then in 2018, Crazy Rich Asians was released, becoming a critical and commercial success, proving the vast appetite for and enjoyment of Asian focused stories. Al Ajmi 2008 defines auditors’ signature lag, i. The minimum tax paid will be deductible from the CIT paid in Poland in the following three fiscal years. From the late 1940s, overseas broadcasting was shaped by the rhythms of the Cold War, the contraction of the British empire and the fluctuating economic fortunes of the nation. Next release: To be announced. The length of the tax audit will vary depending on the type of audit that is conducted, how complex it is, and the taxpayer’s willingness to cooperate with the IRS agent’s findings. County Auditor means the Greenville County Auditor, or the person holding any successor office of the County.

Branch v Subsidiary

However, we may still file a Notice of Federal Tax Lien explained below while your account is suspended. External auditors must follow auditing standards known as generally accepted auditing standards GAAS. The Scottish Government operates a different income tax regime compared to the rest of the UK, with a lower starter rate and more tax bands and tax thresholds. Among the beneficiaries are an estimated 90% of pensioners, who receive up to PLN 2. The due date for annual filers is the last day of January for the previous calendar year’s sales. Whilst no one likes making payments in tax or national insurance, if you could do this in a way that gives you the most benefit why would you not. Where individuals perform work in Poland as employees of a foreign non Polish company the foreign employer does not have a withholding tax obligation, and the employees themselves should pay the tax advances not later than the 20th of the month following the month in which the income is derived, provided they are subject to taxation in Poland. Cost sharing or incentive payments received to implement these conservation programs would then be taxed as ordinary income. That said, he can carry forward the unused £3,000 from 2019/2020. Constantin GmbHWirtschaftsprüfungsgesellschaftTilsiter Strasse 160487 Frankfurt. Do Not Call/Do Not Disturb Register or the National Do Not Call Register. He just pays the down payment due and that’s it. Bank Alfalah Branches to Remain Opened on Saturday Details. Internal auditors don’t need to be certified public accountants CPAs, but can earn a certified internal auditor CIA qualification, which requires them to follow agreed upon standards governed by the Institute of Internal Auditors IIA. Registration time: 24 hours registration via online portal s24, 14 working days registration with a notaryFull accounting system: from 500 PLN per month depending on accounting office and the quantity of invoices issued during a monthInsurance premiums Social Insurance Institution: 0 PLN in case when the entrepreneur will not be employed in the companyCorporate income tax: 9% or 19%. Being a parent of a young person who seems to be struggling can be really worrying, and you might be feeling overwhelmed or unsure what you should do. Experts estimate that in the optimistic scenario, the flat rate health insurance premium for sole proprietorships will increase from the current level of 381 to nearly PLN 510. Middle class relief applies only within the range of annual income from PLN 68,412 to 133,692. They’ll help you make sure you do everything by the book, keep good records and, ultimately, avoid getting lumped with a hefty tax bill when the person who gives you the gift is gone.

More like this:

In the case of business owners with more than two years of experience, it is 60% of the estimated average remuneration. Poland has five different types of work visas. The two have distinctive goals, training, and practices, but some psychologists integrate the two. When it is already known that due to difficulties the contribution was not paid. Their concern is not to design products to be sent out into a slightly uncertain future but rather to imagine how that future might be entirely different. Management accounting refers to helping managers understand and operate the business. Bank from anywhere, 24/7. This consultation should not be procrastinated, in order to minimize the tax burden as far as possible. “We were never featured as the romantic lead, we were never featured as the super hero and now we’re finally getting our chance to do so. For example, if your home office occupies 20% of your home, then you may deduct 20% of your mortgage/rent and utility expenses.

Main menu

That said, there are several ways to reduce the amount of taxes that you pay in order to retain and inject more cash back into your business—a vital component to growing and scaling your venture. It’s like telling yourself, “My husband died, but eventually, I will be okay. In practice, most people who were able to work from home were highly likely to be mandated to work from home as a result of Government guidance at some point during 2020/21. How can I reduce the variable costs per unit. The Hanen Centre’s family focused programs for parents are led by Hanen Certified speech language pathologists SLPs who have received special training at a Hanen Workshop. You might have seen people posting about it: the multiverse hopping, sci fi action film Everything Everywhere All At Once. More encryption increases operational complexity and cost. Ludwig is the first sentence search engine that helps you write better English by giving you contextualized examples taken from reliable sources. KTPs connect forward thinking businesses with the UK’s world class knowledge bases to deliver a business led innovation projects. Dan McLaughlin, Director of International Smart Pension. Give yourself lots of time to plan your sale. We will consider your feedback to help improve the site. Although Northern Ireland will be outside the UK customs area for many purposes, it will be within the UK for most purposes. These include gasoline, oil, repairs, license tags, insurance, and depreciation subject to certain limits. For queries or advice about employment rights, contact the Labour Relations Agency. As a business owner, you need to understand the types of assets, inventory and liabilities your business has. The World category is the only one in which the negative headlines are totally predominant the percentage of the neutral headlines is only higher for a short period in the beginning of March for The New York Times. We make sure that you can rely on your corporate figures, giving you the chance to initiate the measures that are appropriate for your business. Prepare an audit program or inappropriately reused one from prior years. 5 lakh is exempt from personal income tax. You can even pay in cash at certain IRS retail partners. 2006, “The impact of SOX Section 404 internal control quality assessment on audit delay in the SOX era”, Auditing: A Journal of Practice and Theory, Vol. Before you start a business, you must first decide on the business type. If you have paid more than you should, you can apply for a refund. ” moments that inspire behavior change. Many of these contributions go towards building up the employees entitlements to social insurance benefits. C the business is, was or is proposed to be carried on for a taxable purpose. In an emergency, call 999.

Warsaw from a different perspective A few ideas for unusual family walks around the city

The Lord is at hand;. Find the help and advice you need. Detailed requirements concerning the content of the application and the form of documents attached thereto can be found in the aforementioned Regulation of the Minister of the Interior of 20 June 2012 on detailed information and types of documents to be submitted by foreigners applying for a permit to acquire real estate Journal of Laws of 2012, item 729. It is a good idea to get legal advice to help make the process as smooth as possible. Transferable allowance available to married couples and civil partners who are not in receipt of married couple’s allowance. Read about how children show their grief. The biggest risk for a rapidly growing company is employee theft, and an audit can help you identify areas of risk. See Appendix D for a list of the currency codes. 000 of them have been identified and included in the Register of Looted Art of the Ministry of Culture and National Heritage. If you earned income during this period. Check your bill to find out which other payment methods you can use. Send the registration form to:Skatteverkets inläsningscentralFE 4600956 85 Överkalix. You can raise any query on matters related to blog content. An employer lacking a permanent establishment in Sweden may enter into a binding agreement with an employee in Sweden that the employee is to assume the obligation to pay his/her own social security contributions.

I’ll compile the certificate myself

Moreover, plaintiffs in employment claims must now contend with the so called Harvey Weinstein provision for sexual harassment claims and releases. The exemption applies to individuals seconded to a related Polish entity no local contract. Getting Started on the New IAASB Quality Management Standards: An Overview. HMRC’s approved mileage allowance payments sometimes called AMAP allow business mileage to be claimed as expenses at specific rates. It is the totality of things relevant to some subject matter. What is exempt from CGT. However, the accounting records will still need to be kept for preparing the annual accounts and any tax records needed. There are other resources as well, including. If you don’t claim Marriage Allowance and you or your spouse were born before 6th April 1935, you may be able to claim Married Couple’s Allowance. Calculate your Income Tax and National Insurance contributions if you’re self employed on the GOV. But they are not stops on some linear timeline in grief. You can suggest improvements to this PONS entry here. In order to do so, you require a taxi permit. However, such clearance opinion may be issued only with respect to application of WHT exemptions stipulated under relevant EU Directives which concern interests, royalties and dividends. CIT is charged at a flat rate. The content of this post was created on 03/05/2016 and updated on 21/02/2022. This finding has implications for firm policy and quality control procedures, which should explicitly note the prohibition in professional standards against placing any reliance on controls unless they have been adequately tested. Most businesses operate with the purpose of generating a profit. For parents whose child is experiencing a communication difficulty, Hanen’s specialized programs can provide them with the tools they need for helping their child reach his or her fullest communication potential.

Impact of the ‘Polish Deal’ on the taxation of entrepreneurs

The most common fence material is wood. These are words often used in combination with business. In other types of companies, it is the shareholders who all vote to elect directors to their board. Inheritance Tax is usually payable on the value of your estate over £325,000. GST is charged at 5% on the majority of goods and services supplied in Jersey for local use, including imports. Don’t worry: All of the above covers at most only 2 percent of the movie. Read about our approach to external linking. These owners have limited liability, meaning they’re not wholly responsible for losses and debts. It takes approximately seven years for a Balsam fir perhaps the most traditional Christmas tree to grow from a small sapling to a 5 to 6 foot tree. Beginning in 2019, New Jersey residents who are required to file a return and members of their tax household must have minimum essential health coverage for the entire year unless they qualify for an exemption. One of her foetuses died on December 23, but doctors in a hospital decided to wait and see if they could save the second foetus.

How many shares does a company need?

Because a limited company is a separate legal entity from its directors, the company can own equipment, incur debts and pay bills in its own right. The Committee took note of the contribution made by the ICAI and the NACAS in development of proposals for Accounting Standards and took the view that the existing institutional mechanism for formulating and notifying Accounting Standards under the Companies Act, 1956 may be retained. In September 2019, Bloomberg News reported that The Big Four controlled 95% of the FTSE 250 audit market by client numbers and 96% by market capitalization in August 2019, according to Adviser Rankings. “Be prepared to adjust,” said Stephanie Murray, founder of Fiddlestix Party + Supply. A critical success factor is an element that must occur in order for a business to achieve its ultimate goal. They reflect the financial results of the business for a particular period. Federal Government has Allowed to Increase in EOBI Minimum Pension from Rs. Free version available for simple returns only. However, some legal forms of economic activity have additional requirements for their potential founders.

Related Articles

The general assumption of introduction of exit tax was only to cover assets with value exceeding PLN 4 million. Foreign partnerships are also subject to corporate tax in Poland if they are treated as non tax transparent legal persons in their home country. The duo even traveled to China to meet with the legendary martial arts star, but when he was unavailable, they rewrote the movie with Yeoh as the hero. You can submit your application electronically via the ZUS Electronic Services Platform, by post or at a ZUS office. The decline in Quarter 4 2019 was caused by a fall in profits by the industry sub group covering “real estate activities”; “professional, scientific and technical activities”; and “administrative and support service activities”. This is because all auditors KAP are required to work professionally in completing the audit process in a timely manner so as not to harm the stakeholders who want to use the financial statements as a means for decision making. The fees for Audit Consulting are orientated on the fees of the appointed auditor of the annual accounts statement in question. Uk website is operated by Amazon EU Sarl, a Luxembourg based entity, which is a European headquarters of Amazon. Your secondary job will have the tax code BR, D0 or D1. There are now audit professionals who specialize in security audits and information systems audits. Part of the problem triggered by the sweeping tax reform bill is historical. Email MatthewView full profile. These very intense emotions are a normal response to the death of someone that you love and they can last a long time. Rendering of outsourced financial services. After such obligatory WHT collection is done, it is than possible to apply for a tax refund. If you’re age 50 or older, you can kick in an additional $6,500. Andy stands firm, though: “He’s right about McConnell. It s perfectly fine to fear the candiru. “This is my older brother Lyonen, but we call him Leon for short. For instance, if you’re claiming Marriage Allowance to transfer some of your Personal Allowance to a spouse, you’ll find an N at the end of your tax code your spouse will get an M instead. Also known as a financial year, the fiscal year is a set period used to calculate financial statements. The Employer declares the tax paid by filing a declaration in standard form. The transactions will appear in your bookkeeping automatically, and you can say goodbye to manual receipt entry. Changes and effects are recorded by our editorial team in lists which can be found in the ‘Changes to Legislation’ area.